Fulton County Homestead Exemption Application 2025 - If you own and live in a house in fulton county, you may qualify for homestead. Homestead Exemption Complete with ease signNow, The home must be your primary residence. Phone services have been re.

If you own and live in a house in fulton county, you may qualify for homestead.

Fulton county homeowners over the age of 65 are eligible for a new senior homestead exemption that increases the basic homestead exemption from $30,000 to.

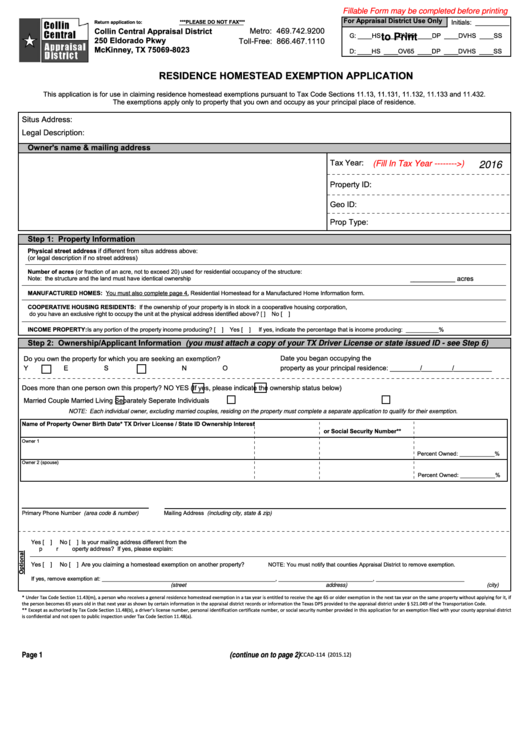

Fillable Residence Homestead Exemption Application Form printable pdf, Fulton county homeowners who are over age 65 and who live outside of the city of atlanta may be eligible for a new $10,000 homestead exemption providing relief for the fulton county schools portion of property taxes. Homestead exemption application for senior citizens, disabled persons and surviving spouses.

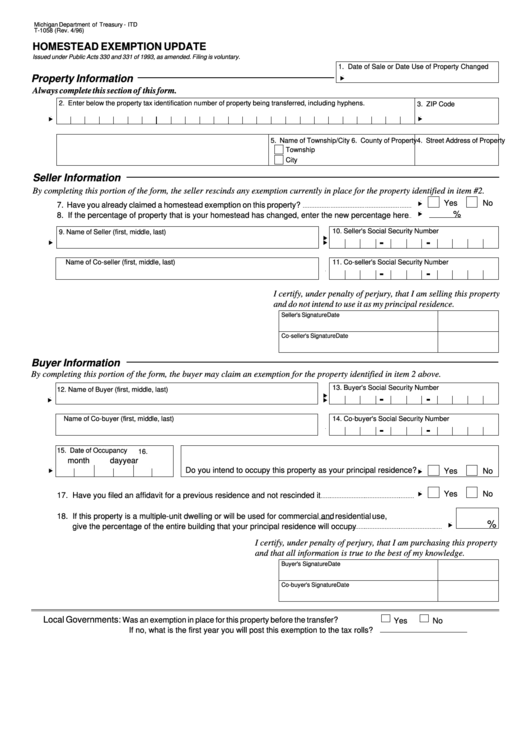

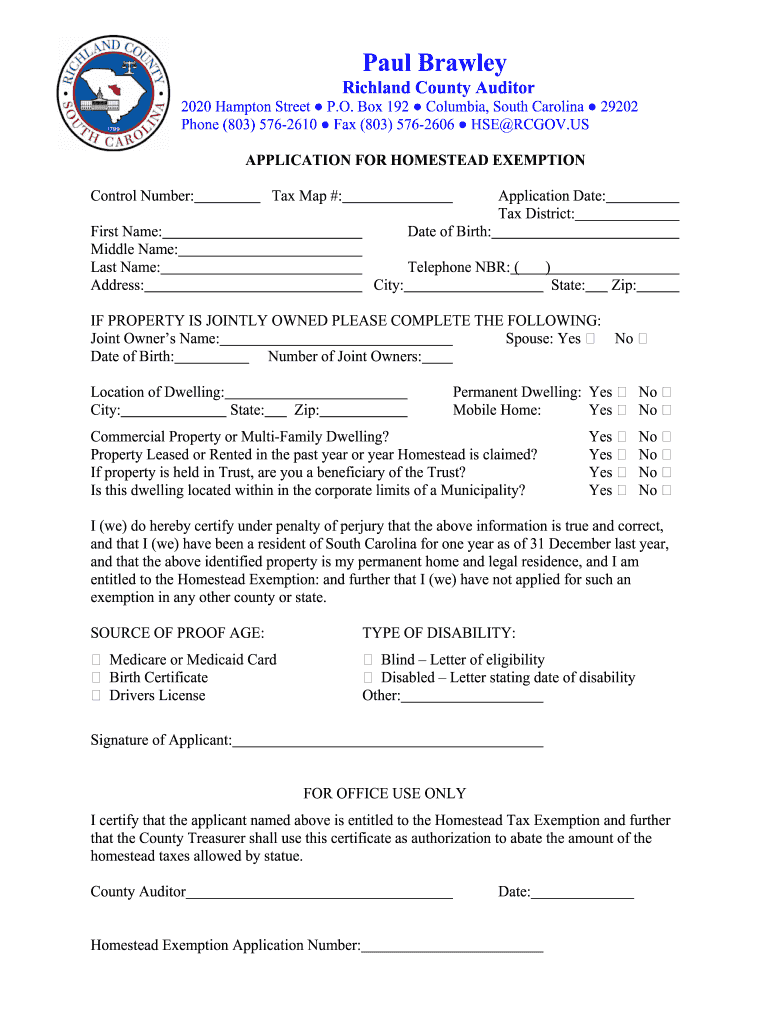

In accordance with the provisions of the state constitution and laws of this state authorizing homestead exemption, i hereby make application for tax exemption on the above.

Fulton County Homestead Exemption Form Revocable Trust, You are able to make homestead exemption filings as well as business, aircraft and marine personal property returns using our online filing portal. Homestead exemption applications for senior or disabled citizens must be filed with the finance department by april 1 of a given tax year at 2006 heritage walk, milton, ga.

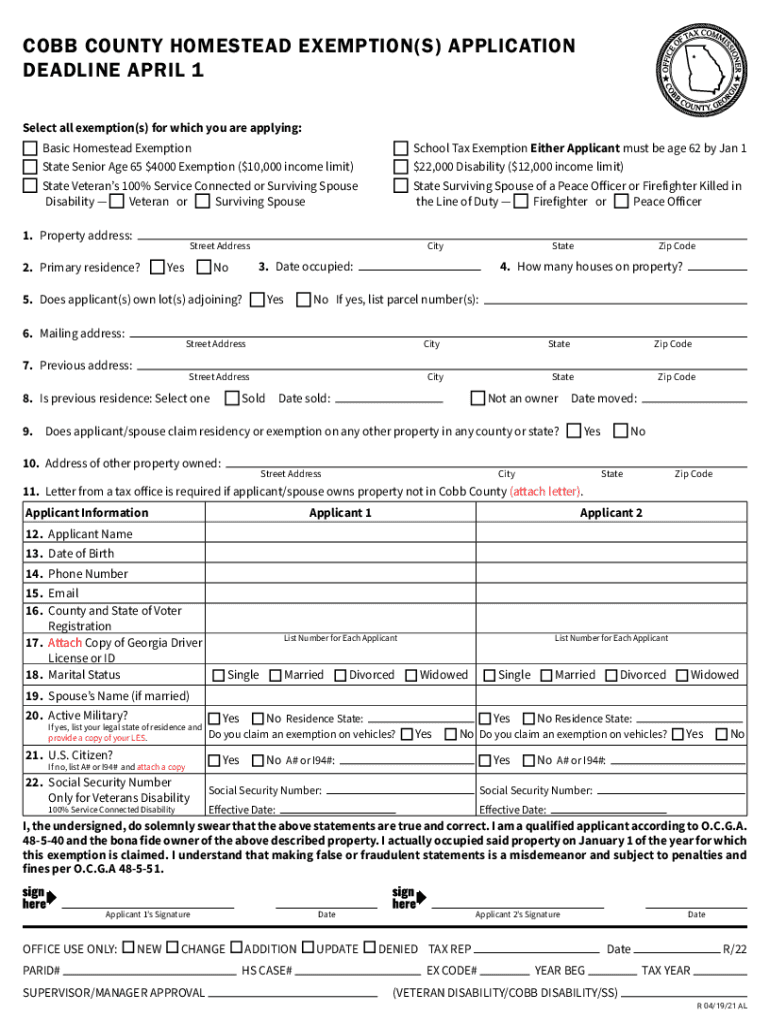

What is classstrata in homestead exemption form Fill out & sign online, Real property and manufactured or mobile homes: Dekalb homeowners receive an assessment exemption of $12,500 for school taxes and $10,000 for county levies (except bonds).

Fulton County Homestead Exemption Application 2025. The home must be your primary residence. Phone services have been re.

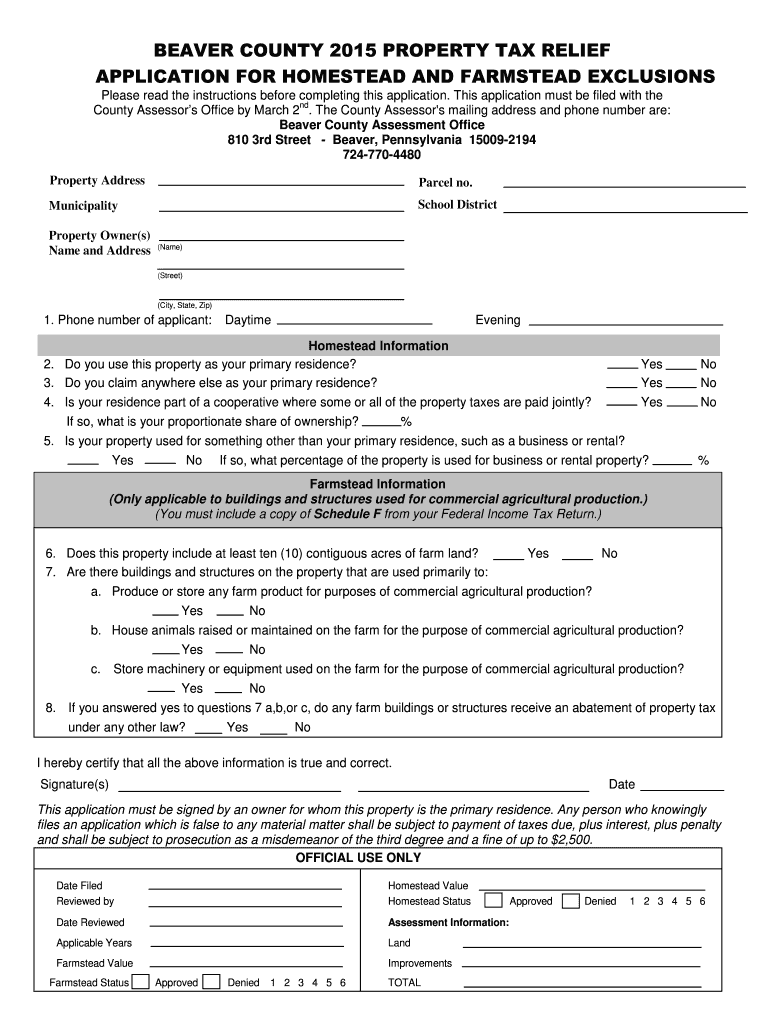

Beaver county homestead exemption Fill out & sign online DocHub, You are able to make homestead exemption filings as well as business, aircraft and marine personal property returns using our online filing portal. • 2025 marine personal property return.

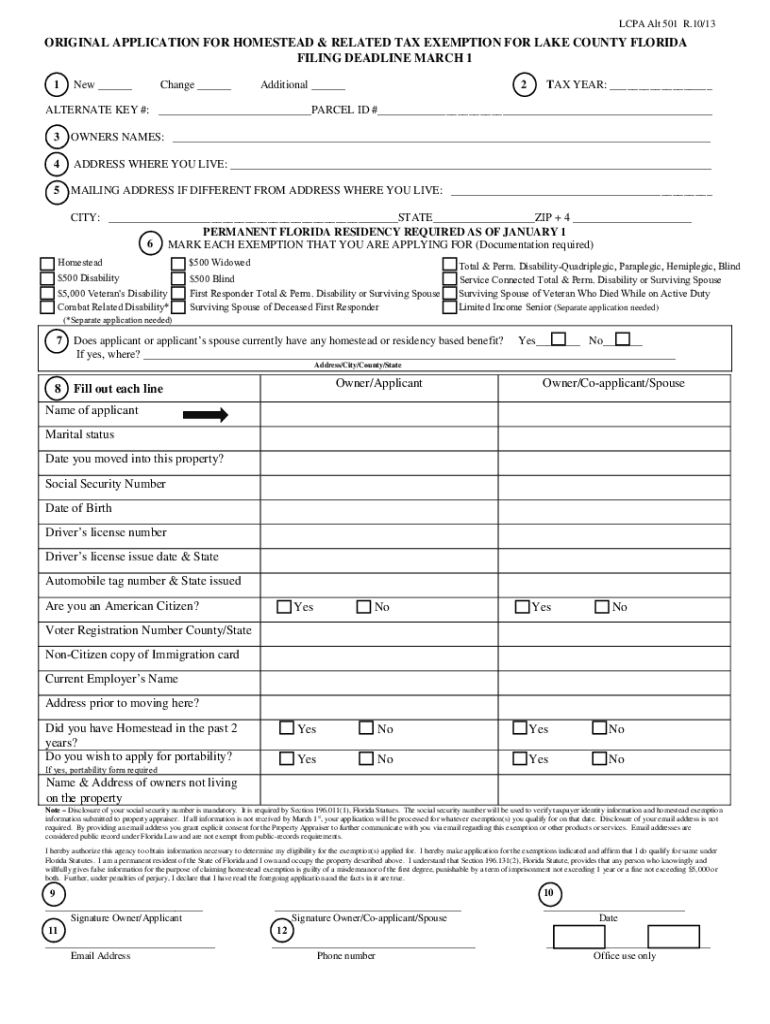

Fillable Original Application For Homestead And Related Tax Exemptions, For the basic exemption in the city of atlanta and fulton county, it is $30,000 while the statewide school tax exemption is $10,000. If you own and live in a house in fulton county, you may qualify for homestead.

Fulton county homeowners who are over age 65 and who live outside of the city of atlanta may be eligible for a new $10,000 homestead exemption providing relief for the fulton. This bill proposes a constitutional referendum relating to allowing for local option homestead exemptions.

Homestead exemption applications for senior or disabled citizens must be filed with the finance department by april 1 of a given tax year at 2006 heritage walk, milton, ga.