Irs 2025 Hsa Contribution Limits Over 55 - At age 55, individuals can contribute an additional $1,000. $4,850 single coverage $8,750 family coverage. Irs 2025 Hsa Contribution Limits Over 55. Under guidance the irs announced tuesday that goes into effect next year, individuals can contribute as much as $4,150 to an hsa each year, a 7.8% increase. For individuals covered by an hdhp in 2025, the maximum contribution limit will be $4,150.

At age 55, individuals can contribute an additional $1,000. $4,850 single coverage $8,750 family coverage.

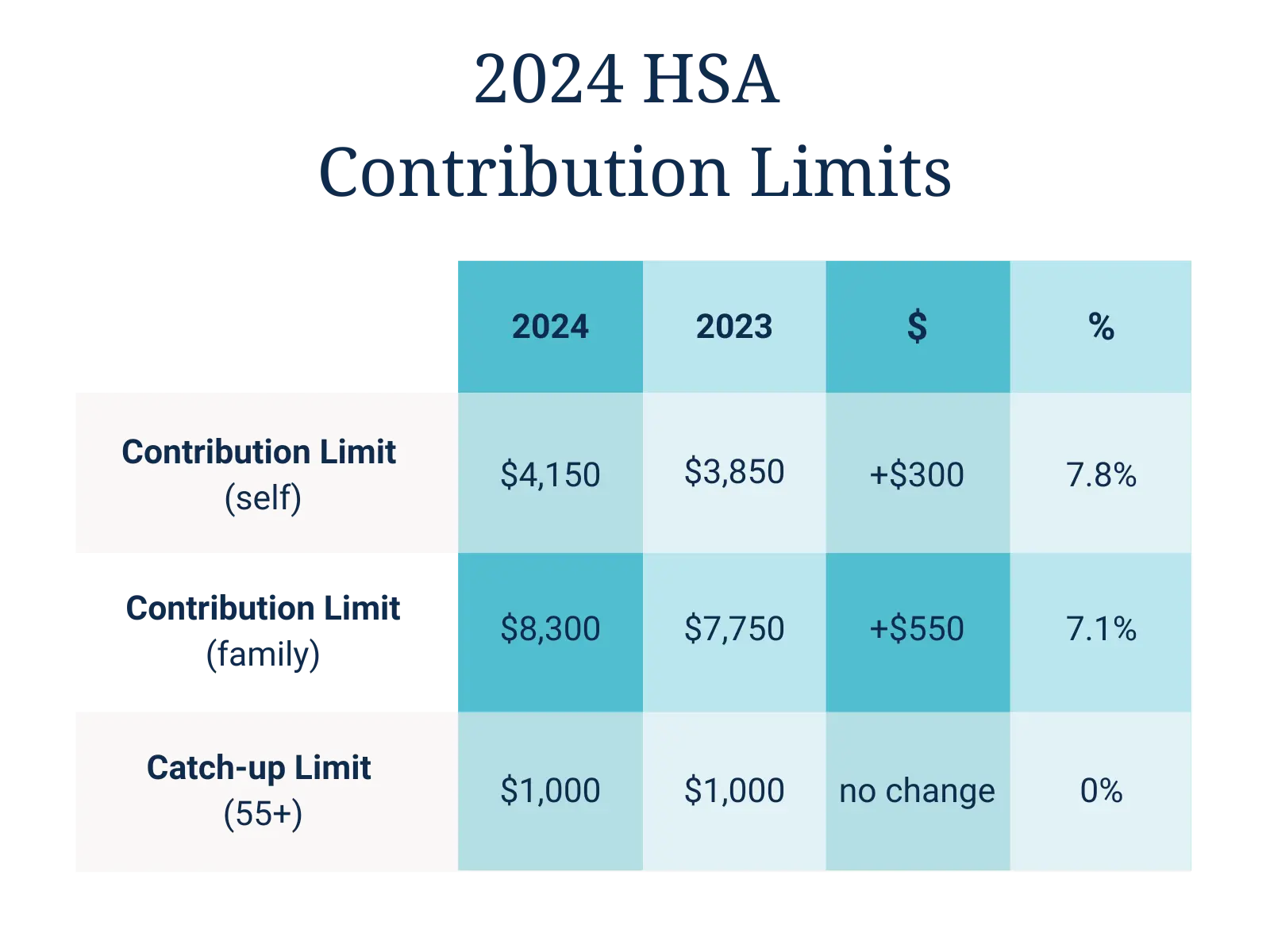

The 2025 hsa contribution limit for family coverage (employee plus at least one other covered individual) increases by $550 to $8,300.

HSA Contribution Limits For 2023 and 2025, That still applies for 2025. (people 55 and older can stash away an.

2025 Contribution Limits Announced by the IRS, Hsa regular contribution limits for 2025: The 2025 hsa contribution limit for family coverage (employee plus at least one other covered individual) increases by $550 to $8,300.

Sep 2025 Contribution Limit Irs Ceil Meagan, Under guidance the irs announced tuesday that goes into effect next year, individuals can contribute as much as $4,150 to an hsa each year, a 7.8% increase. Maximum employer contributions for excepted benefits:

IRS Announces HSA Limits for 2025, For individuals covered by an hdhp in 2025, the maximum contribution limit will be $4,150. Your contribution limit increases by $1,000 if you’re 55 or older.

Hsa Family Contribution Limit 2025 Riva Verine, Hsa contribution limit for 2025 (employee + employer) $4,150. (people 55 and older can stash away an.

Significant HSA Contribution Limit Increase for 2025, (people 55 and older can stash away an. The 2025 hsa contribution limit for family coverage (employee plus at least one other covered individual) increases by $550 to $8,300.

IRS Makes Historical Increase to 2025 HSA Contribution Limits First, You can see the difference between the 2023 and 2025 hsa maximum contribution amounts in the chart. This means that an individual can.

IRS Issues 2025 HSA and EBHRA Limits Innovative Benefit Planning, Under guidance the irs announced tuesday that goes into effect next year, individuals can contribute as much as $4,150 to an hsa each year, a 7.8% increase. The 2025 hsa contribution limit for family coverage (employee plus at least one other covered individual) increases by $550 to $8,300.

12+ Hsa 2023 Contribution Limit Irs For You 2023 GDS, Hsa regular contribution limits for 2025: This means that an individual can.

How Much Can I Put Into My Hsa In 2025 Joane Lyndsay, This means that an individual can. At age 55, individuals can contribute an additional $1,000.